Cannabis-infused beverages may only represent a small portion of the overall legal market in the U.S. and Canada now, but there are several reasons to believe that may change, and quickly.

Several companies—from cannabis giants like Canopy Growth and Acreage Holdings to historic, household brands like Pabst Blue Ribbon (PBR)—have placed their bets on cannabis-infused beverages, announcing releases (or plans to) in Q4 2020.

In the case of PBR, which agreed to allow the independently operated Pabst Labs to use its brand for its new THC-based drink, the company and many others are fueling a growing niche within the cannabis beverage niche–THC-infused tonics.

And if the popularity of sparking water brands like La Croix and alcohol-based hard seltzers are any indication, these bubbling beverages may be the drink that takes this edibles segment to the next level.

Poised for Growth

The edibles market represents 15% of all cannabis sales in the U.S., according to a recent webinar hosted by industry research firm BDSA, and beverages make up just a small portion of edibles sales at 5%. In Canada, those figures are 6% and 3%, respectively, according to BDSA. But there is evidence of growing interest.

Of U.S. cannabis consumers, nearly a fifth consume beverages and 8% prefer them, according to BDSA.

A Brightfield Group Q2 2020 survey of 3,500 U.S. cannabis consumers showed similar trends, as 22% reported consuming a cannabis-infused drink. That’s compared with 57% consuming flower and 41% consuming gummies, according to Brightfield.

But, “the category has seen significant growth year over year. In Q3 2019, only 14% of cannabis consumers were using drinks,” Bethany Gomez, managing director of Brightfield Group, said in an email to Cannabis Business Times and Cannabis Dispensary. “We do expect this growth trajectory to continue year over year, but given that products are generally sold as a single serve product, the percentage of the overall market is quite low.”

That’s one problem that cannabis beverage brands are trying to solve by offering drinks in multipacks, similar to soda and beer.

The brand Cann Social Tonics, which is available in California, Nevada and Rhode Island, sells its products in six-packs and 24-can “party packs.” The idea was to make a drink that looks and feels just like any other beverage you’d take to a party and share with others, mimicking other consumer packaged goods, said Cann co-founder Luke Anderson in an interview with Cannabis Business Times and Cannabis Dispensary in September.

“I think carbonated beverages are having a moment,” Anderson said. “The sparkling water market’s evolution over the last few years is a sign of people looking for something that has a little bite to it and a little bit of texture. So we want [Cann] to integrate in the same social settings and have people think about them the same way they do a beer, a light beer, a hard seltzer or a craft cocktail in a can.”

Part of the challenge was making something that wasn’t overly sweet taste good, and not relying on “hundreds of calories to mask the taste of cannabis,” said Cann co-founder Jake Bullock. They also wanted to create a beverage that allowed people to control their dosages more easily and where they could enjoy a couple and not be overly intoxicated.

“If you think about products like other mild intoxicants—caffeine, alcohol—we consume them in a beverage, and most importantly, in that beverage, we consume them in a microdose,” Bullock said. “We’re not running around drinking eight shots of espresso or Everclear grain alcohol. When you bring the dosing way down, it becomes approachable for new consumers, it becomes social, it can integrate and behaves as the same strength as a glass of wine or a light beer.”

Cann offers flavors such as lemon lavender, grapefruit rosemary and blood orange cardamom, and each can contains 2 mg of THC and 35 calories, one of the lowest in both categories in the cannabis beverage market. According to BDSA, Cann is now the third highest-selling cannabis beverage in legal markets in the U.S.

“That’s really our vision is just to continue to produce approachably dosed, nothing more than five milligrams, THC beverages that welcome in a whole new wave of consumers,” Anderson says.

Familiar Brands Fuel Acceptance

Combining cannabis with a familiar “form factor,” beverages are one avenue to further destigmatize cannabis use and can attract consumers who may not be comfortable with smoking, vaping or other consumption methods. When you integrate a brand that’s been around for 175 years with cannabis, that can encourage people who may be unfamiliar with cannabis or had a bad experience in the past to try again, said Austin Stevenson, chief innovation officer of Vertosa, which helped develop Lagunitas Hi-Fi Hops, a “hoppy sparkling water,” and Pabst Blue Ribbon Cannabis-Infused Seltzer.

“PBR is over 175 years old, and so what having a brand like PBR does is it crosses generations of cannabis consumers,” Stevenson said. “We know, aside from millennials, that people over the age of 55 are one of the fastest-growing segments of cannabis consumers, and to be able to have your 20-something-year-old get a PBR and go home to their grandparents and say, ‘Look, here is the brand that you grew up consuming,’ but now with a cannabis function, it only helps to normalize and destigmatize the industry.”

Mark Faicol, brand manager of Pabst Labs, which was founded by a group of beverage experts and former PBR employees, said although one target customer is brand loyalists, he sees PBR further contributing to the wider acceptance of cannabis.

“We have a unique—call it competitive, advantage—but really a history in the market, being around for so long … as a trusted well-respected brand,” Faicol said, adding that Pabst Labs has the opportunity to leverage that.

Pabst Labs launched its cannabis-infused seltzer in California with one simple, “easy to understand” flavor – lemon, which is also part of the company’s strategy to appeal to a diverse, wide audience. Each can contains 5 mg of THC, 4 grams of sugar and just 25 calories, and they come in four-packs. Although more flavors may be introduced, Faicol said the initial goal was to, “Do one thing, and do it well, and really be very simple and approachable. Lemon is [a flavor] that is very sessionable and most widely accepted, at least that’s what our data pointed toward.”

Responsible dosing was another focus for the company, Faicol said. Although many consumers still purchase based on price per milligram in an attempt to get the most value out of products, that can lead to negative experiences. He also points out that while people may have had one – or many – hangovers, they continue to drink alcohol, but one bad cannabis experience can drive a consumer away for good.

“That’s something that the brands in beverages are really kind of working together on, to educate on proper dosing,” Faicol said. “And I think it will only help the category at large.”

While more consumers may be coming on board, there are challenges in distribution logistics and placement in dispensaries, especially in legacy markets that were built to merchandise flower, edibles and other traditional products, and may not be configured to include refrigerators displaying drinks, Stevenson said.

“They weren’t built like a 7-Eleven for beverages,” Stevenson said. “They haven’t invested in it. They don’t have the floor space either because of regulations … or those investments haven’t been there.”

However, as newer markets in the Midwest and East Coast continue to grow, Stevenson says he sees new opportunities to encourage cannabis companies to build and develop dispensaries with beverages in mind—and get the buy-in from regulators, too.

“[Vertosa] is looking at Illinois, at Michigan, Massachusetts, these big beer-drinking markets where they’re getting cannabis regulation for the first time. When we have brands like Lagunitas, like PBR, when we enter these new markets, we want to make sure that the consumer retail experience highlights these opportunities to have a more approachable type of product,” he said. “In these new markets, you’re going to build retail experiences that have cooler spaces that have displays. I work at both the state level and the local level on some regulatory policies to help promote and make consumers and business operators aware that cannabis beverage is here, but the retail channel needs to be able to support product placement like any other traditional retailer.”

Catering to Experienced Consumers

While low-dose beverages can serve as an entry point for those who are curious but hesitant to try cannabis, offering a wide variety of products is important to reach the more seasoned consumer, too, Stevenson said.

“For your introductory consumer, you’re going to go with a low-dose product, 5 milligrams of THC, and that can be had any time during the day,” Stevenson said. “Now how you differentiate is you look at the [Lagunitas] Hi-Fi Hops portfolio, and they have a THC product that is 10 milligrams, and then they also have a CBD product that’s [18 milligrams CBD]. And so the CBD product is more for the relaxation.

“And so by building a beverage portfolio, that’s how you start to address the different consumer functional needs by changing the different ratios of cannabinoids of THC versus CBD or high-dose versus low-dose.”

Brightfield Group’s Bethany Gomez said thinking about who your consumer is and how they want to experience your product is important when building a brand.

“If you are pitching [a] cannabis beverage as an alcohol substitute, it needs to be effectively positioned for the same occasions that people are using alcohol,” Gomez said in an email. “But many consumers use cannabis and alcohol quite differently, in different [times of day] or during different moments of consumption, [such as] before a workout or to inspire creativity, which makes it not as straightforward a substitute.”

However, just because a beverage is marketed a certain way doesn’t mean that’s how it will be consumed. Take the example of Cann. Although the founders couldn’t predict the coronavirus pandemic nor the effect on sales of a drink they envisioned being a “social” tonic, it did not have a negative effect on company growth, Anderson said.

“The toughest part of this company was the first year on market, our sales were relatively flat. Consumers loved the product, but they couldn’t really understand how to think about it because alcohol was dominating their social [lives] and bars were open,” he said. “You could have a Cann at a pregame. You could have a Cann on a weeknight, but come Friday, you’re trained to go out and you’re trained to just drink whatever is available to you on tap.”

Once states began instituting stay-at-home orders and closing bars, that’s when things changed, Anderson said. Sales increased 10 times what they were before the pandemic, he said.

“This idea that people were buying a bunch of cannabis to ease their anxiety was the first wave of the sales spike,” Anderson said. “People were enjoying the fact they could feel a buzz and hang out and laugh and have a good time, but not feel like crap the next day.”

Paying attention to these consumer preferences and how they evolve is an important part of driving innovation and sales, Faicol said.

“[PBR] made a conscious decision to change. We’re a beer brand through and through, but we made a decision many years back that, the consumer is going to want something else. And America is going to look very different … five years from now,” Faicol said. “But I think that’s going to be a critical driver, is the ability for brands to continue to innovate, and really keep it exciting, which we’re committed to do.”

This article has been updated from its original version to clarify that Hi-Fi Hops is a nonalcoholic, hoppy cannabis-infused sparkling water, not a nonalcoholic, cannabis-infused beer.

More Stories

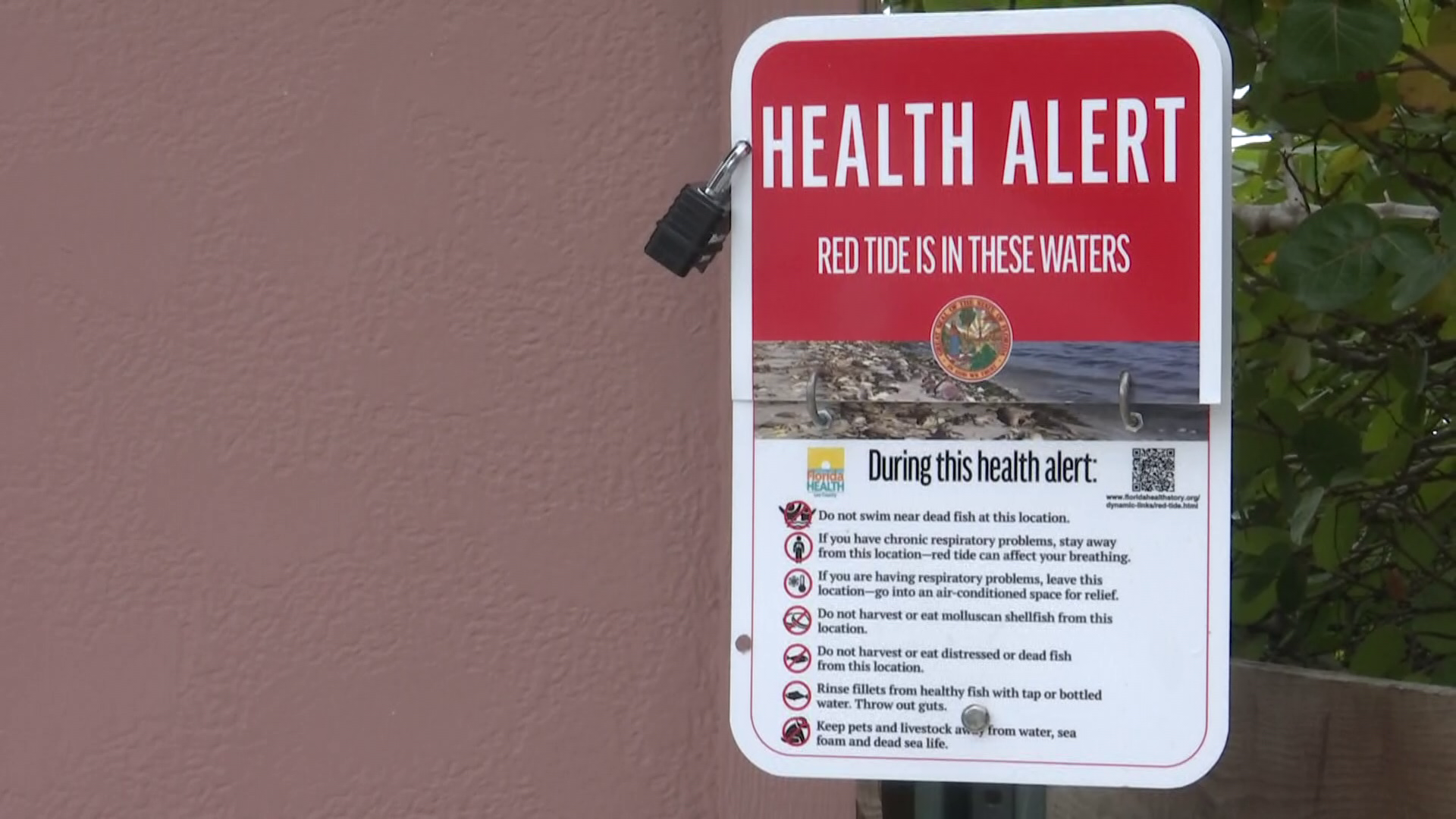

DOH-Lee troubles well being alert for pink tide alongside Lee County coast

Critically Endangered: ‘Iconic’ sea star now detailed | Information

Check out Now: How the Winnebago are planting ancient corn to regrow their lifestyle | Nebraska Information